Ex-Dividend Dates: When Are You Entitled to Stock and Cash.

The ex-date or ex-dividend date represents the date on or after which a security is traded without a previously declared dividend or distribution. Usually, but not necessarily, the opening price is the last closing price less the dividend amount.However, this method can also backfire because stocks are volatile and often increase just before the ex-dividend date and fall on or in the days following the ex-dividend date. For example, the.Ex-Dividend Date. The ex-dividend date is the date which is used to decide which shareholders will receive a dividend payment. Shareholders who own shares in the company before the market opens on the ex-dividend date will receive a dividend payment. Shares bought on or after the ex-dividend date will not qualify for the dividend.

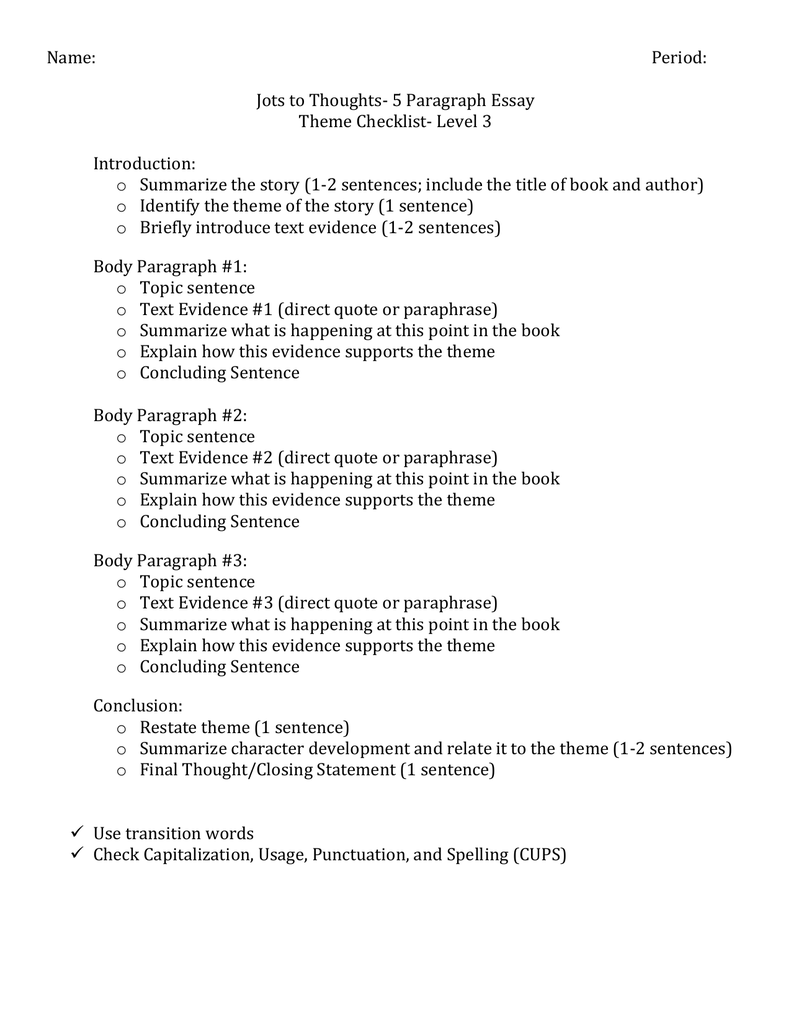

Watson, G. 1987: Writing a Thesis: a Guide to Long Essays and Dissertations. London: Longman. There are also software programs, for example, Endnote and Refworks that are designed to manage references. They include the facility to incorporate 'author, date' insertions within your text, and to format reference lists automatically.Ex-dividend date The first day of trading when the buyer of a stock is no longer entitled to the most recently announced dividend payment ( i.e. the trade will settle the day after the record date, too late for the buyer to appear on the shareholder record and receive the dividend.) The date set by the NYSE (and generally followed on other U.S.

Examples of ex-dividend date in the following topics: Defining Dividends. In-dividend date is the last day, which is one trading day before the ex-dividend date, where the stock is said to be cum dividend ('with (including) dividend').After this date the stock becomes ex-dividend.; Ex-dividend date (typically two trading days before the record date for U.S. securities) is the day on which all.